Bookkeeping

Orderblocks and Liquidity Voids for BITFINEX:BTCUSD by Pheneck

Contents:

Thus, the stock for a large multinational bank will tend to be more liquid than that of a small regional bank. Securities that are traded over the counter , such as certain complex derivatives, are often quite illiquid. Moreover, broker fees tend to be quite large (e.g., 5% to 7% on average for a real estate agent).

This professional bookkeeping service would be unable to pay its $10,000 rent expense without having to part ways with some fixed assets. If an exchange has a high volume of trade, the price a buyer offers per share and the price the seller is willing to accept should be close to each other. In other words, the buyer wouldn’t have to pay more to buy the stock and would be able to liquidate it easily. When the spread between the bid and ask prices widens, the market becomes more illiquid. For illiquid stocks, the spread can be much wider, amounting to a few percentage points of the trading price.

Asset Account Classifications

Some things you own such as your nicest shirt or food in your refrigerator might be able to https://1investing.in/ quickly. Others such as a rare collectible coin or custom painting of your family may be a bit more difficult. The relative ease in which things can be bought or sold is referred to as liquidity. A ratio of 1 or more indicates enough cash to cover current liabilities. Intuitively it makes sense that a company is financially stronger when it’s able make payroll, pay rent and cover expenses for products. But with complex spreadsheets and many moving pieces, it can be difficult to see at a glance the financial health of your company.

- Supporting documentation for statements, comparisons, statistics or other technical data provided is available by contacting Cboe at/Contact.

- During the depths of the recession, some homeowners found that they couldn’t sell their homes at any price.

- Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors.

- Cash is the most liquid of assets, while tangible items are less liquid.

- Many companies—not just tech start-ups—offer their employees stock options as part of a larger compensation package.

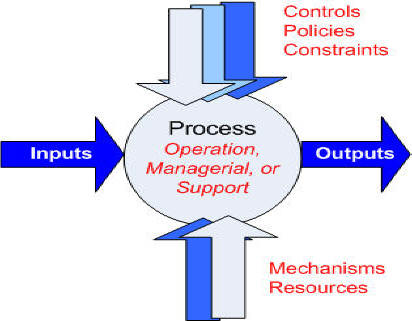

Theoretically, sophisticated trading can result in profits gained at a speed and frequency not possible for a human trader. A more accurate view of market liquidity leads to better algorithmic trading decisions. In the current short-term trading landscape, most traders use the DOM to place their trades. However, many have written off the liquidity display in the DOM, assuming that most of the listed orders don’t have an intent to trade. Hypothetical scenarios are provided for illustrative purposes only. Investments in ETPs involve risk, including the possible loss of principal, and are not appropriate for all investors.

Liquidity

A ratio value of greater than one is typically considered good from a liquidity standpoint, but this is industry dependent. That presents the company’s assets, liabilities, and owners’ equity at a particular point in time, thereby providing insights into an entity’s financial position. Assets are listed in the balance sheet in order of their liquidity, where cash is listed at the top as it’s already liquid. The next on the list are marketable securities like stocks and bonds, which can be sold in the market in a few days; generally, the next day can be liquidated. Liquid assets are things that can be quickly converted into cash without losing value. These come in many different forms, such as cash, stocks, other marketable securities, money market funds and more.

Will convert to cash in accordance with the company’s normal credit terms, or can be converted to cash immediately by factoring the receivables. Cash, public stock, inventory, and some receivables are considered more liquid as a company or individual can expect to convert these to cash in the short-term. Short-term liquidity issues can lead to long-term solvency issues down the road. It’s important to keep an eye on both, and financial ratios are a good way to track liquidity and solvency risk. Savings accounts.Everyone should maintain both a checking account and a savings account, but it’s important to understand that savings accounts are designed to be slightly less liquid.

Minute SCALPING! LIQUIDITY & Order Block Strategy That I Trade Every Week for Day Trading

Any trade that is taken based upon our educational or research materials is at your own risk for your own account. IlliquidIlliquid refers to an asset that cannot be converted to cash. Such assets suffer a valuation loss when sold in exchange for cash. Bonds, stocks and properties are some examples of illiquid investment.

Refinitiv Labs can present a visualization of liquidity via the pricing of limit orders. Traders can use these market liquidity insights to improve their algorithms and make better decisions on manual orders. According to a 2019 survey by JP Morgan, “liquidity tops the list of daily trading issues” for the company’s foreign exchange clients. Traders can apply these market liquidity insights to improve their algorithms, and make more informed decisions.

The Importance of Liquidity

Cboe Futures Exchange The home of volatility and corporate bond index futures. European Derivatives Improving the equity derivatives market through transparency and efficiency. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Ripple Liquidity Hub Bridges Traditional Fiat Systems With the New … – CryptoGlobe

Ripple Liquidity Hub Bridges Traditional Fiat Systems With the New ….

Posted: Fri, 14 Apr 2023 13:49:10 GMT [source]

While they are less risky than individual stocks and bonds, you still may end up having to sell ETFs at a loss if you need your money quickly. This method stores your savings directly in cash, so you don’t have to convert any assets, and the accounts offer many quick and easy withdrawal options. Eventually, a liquidity glut means more of this capital becomes invested in bad projects. As the ventures go defunct and don’t pay out their promised return, investors are left holding worthless assets. Panic ensues, resulting in a withdrawal of investment money.

What Is Liquidity Risk?

M1 includes current held by the public, traveler’s checks, and other deposits you can write a check against. In conclusion, trading liquidity in forex is important for both novice and experienced traders. By using the right trading methods and monitoring news and economic events, you can trade liquidity in forex effectively and profitably. Remember to always use proper risk management and to trade within your means. A trailing stop order is a stop order that is adjusted as the market price moves in your favor. This type of order is used when you want to protect your profits while allowing your trade to continue to run.

Broadwind Announces New $8 Million Order for Mobile Pressure Reducing Systems and Accessories – Yahoo Finance

Broadwind Announces New $8 Million Order for Mobile Pressure Reducing Systems and Accessories.

Posted: Thu, 13 Apr 2023 22:00:00 GMT [source]

However, because of the specialized market for collectibles, it might take time to match the right buyer to the right seller. Let’s calculate these ratios with the fictional company Escape Klaws, which sells those delightfully frustrating machines that grab stuffed animals. Banks and investors look at liquidity when deciding whether to loan or invest money in a business. Ben is the Retirement and Investing Editor for Forbes Advisor.

Cash monitoring is needed by both individuals and businesses for financial stability. The most liquid stocks tend to be those with a great deal of interest from various market actors and a lot of daily transaction volume. Such stocks will also attract a larger number of market makers who maintain a tighter two-sided market. For example, if a person wants a $1,000 refrigerator, cash is the asset that can most easily be used to obtain it. If that person has no cash but a rare book collection that has been appraised at $1,000, they are unlikely to find someone willing to trade them the refrigerator for their collection.

- In forex trading, liquidity refers to the ability to buy or sell a currency pair quickly and easily without affecting the price of the currency pair.

- We are committed to empowering market participants of all types with the information, data and tools they need to navigate the next generation of risk.

- Any statements about profits or income, expressed or implied, do not represent a guarantee.

- Since the money supply is a reflection of liquidity, the Fed monitors the growth of the money supply, which consists of different components, such as M1 and M2.

Marketable SecuritiesMarketable securities are liquid assets that can be converted into cash quickly and are classified as current assets on a company’s balance sheet. Commercial Paper, Treasury notes, and other money market instruments are included in it. Imagine a company has $1,000 on hand and has $500 worth of inventory it expects to sell in the short-term. In addition, the company has $2,000 of short-term accounts payable obligations coming due. In this example, the company’s net working capital (current assets – current liabilities) is negative. This means the company has poor liquidity as its current assets do not have enough value to cover its short-term debt.

Knowing the total value of your liquid assets can be especially helpful if you’re struggling to pay for something in a sudden pinch. That makes them especially valuable additions to your emergency fund. Let’s take a look at the two most common types of liquid assets. Working capital management is a strategy that requires monitoring a company’s current assets and liabilities to ensure its efficient operation. Market liquidity is critical if investors want to be able to get in and out of investments easily and smoothly with no delays. As a result, you have to be sure to monitor the liquidity of a stock, mutual fund, security or financial market before entering a position.